A routing number is a nine-digit number that is used to identify one of the financial institution’s branches in the United States. It is also called a routing transit number or ABA routing number. It is used for identifying and completing money transfers, such as direct deposits and funds transfers. It is assigned to banks and other financial institutions when they join the Federal Reserve System.

Understanding What a Routing Number Is

A routing number or RTN is a nine-digit number that identifies the financial institution – such as a bank, savings and loan association, credit union, or trust account – involved in a transaction. It is also known as an ABA routing transit number or bank routing number, and it is unique to the financial institution.

Routing numbers are used by institutions to initiate and complete financial transactions in the United States, such as direct deposits, drafts, transfers, and wire transfers. Banks and other financial institutions, including investment firms and insurance companies, use routing numbers, while individuals don’t need to worry about routing numbers.

Why Routing Numbers Are Used

Routing numbers are used for financial transactions that involve the exchange of money. The routing number system was created to help financial institutions identify which institution the payment should be sent to or from. This ensures that funds are sent to the correct institution safely and quickly. As the routing number is the identifier for the recipient institution, the recipient institution can ensure that the funds are sent to the correct individual or business.

How to Find Your Routing Number

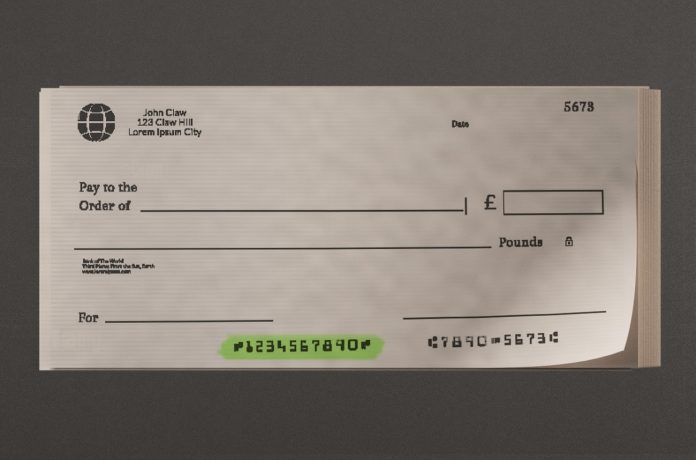

When it comes to locating your routing number, it can be as simple as taking a peek inside your checkbook as the routing number is usually printed at the bottom of checks. This check feature is part of the MICR line, which stands for Magnetic Ink Character Recognition. It is a technology that helps capture and store data on checks faster and more accurately, thus helping to facilitate faster payments.

Alternatively, a routing number can be obtained directly from your financial institution. Most banks list the routing number prominently on the website and/or on account statements.

Here is how to find routing number for your financial institution:

•Search for the financial institution on the web.

•Find the routing number on your financial institution website.

•Contact your financial institution directly by phone.

•Find the routing number on your bank statement.

•Ask a representative at your financial institution.

•Check your checkbook.

For Wire Transfers

Wire transfer routing numbers are different than the routing numbers used for domestic banking transactions. They are also sometimes known as a “SWIFT Code” – Society for Worldwide Interbank Financial Telecommunications. Additionally, banks in some countries may offer their domestic routing numbers and/or international bank account numbers (IBAN) to facilitate international wire transfers.

People may need the routing number of the bank to which they are wiring money. This number can be obtained from the bank’s website or by asking a representative of the bank in person or over the phone.

What Is an ACH Routing Number?

An ACH routing number is an electronic banking routing number that exists for electronic transactions such as direct deposits, electronic payments, direct debits, and online banking. It is the same as the routing number you see printed on your checks from the same financial institution.

In addition, the ACH routing number is also used for fund transfers via the Automated Clearing House (ACH) network, which is a nationwide electronic payments system used for transactions that are not time-sensitive, such as paychecks and Social Security benefits.

A routing number is a nine-digit number assigned to banks and financial institutions when they join the Federal Reserve System. The main purpose of a routing number is to identify and complete financial transactions, such as direct deposits, drafts, transfers, and wire transfers.

To find your routing number, you can look it up on your financial institution website, find it on account statements, call the financial institution, check your checkbook, or ask a representative at the institution. Additionally, you can use SWIFT Code or International Bank Account Number (IBAN) for international wire transfers. Lastly, an ACH routing number is used for electronic transactions such as direct deposits and electronic payments.